Jan 2nd, 2025

Compare Federal Long-Term Care Insurance Prices

2025 Update: In late 2023, the Federal Long-Term Care Insurance Plan (FLTCIP) suspended new enrollments. Many visitors to this page are already aware it’s no longer available. Still, there may be lower cost options on the private market—especially if you’re healthy or married.

Start Your Quote Now to see how private LTC rates compare.

To get ballpark figures of how much Long Term Care Insurance Costs, check out our Online Calculator.

Historical Federal LTC Plan Summary

Federal Employees in the past had access to a Long Term Care program called the FLTCP 2.0. This plan provided a simple Long Term Care policy for federal employees and their spouses. Sometimes the Federal plan’s prices were better than private options, often they were worse. With the Fed LTC plan being sunset, you should compare your private market options.

Good Health Discount

If you’re healthy, you may qualify for a 10–20% discount with private plans.

The Federal LTC Plan did not have a discount for good health.

- Example: A 10% discount on a $2,500 annual premium could reduce your cost to $2,250—saving $250 per year.

Marital / Partner Discount

If you’re married or have a partner, you qualify for discounts in the 30–40% range with private plans.

The Federal LTC Plan did not have a discount for applying with a spouse!

- Missing out on a 40% discount is major.

Single, Standard Health (Not Great Health) Favored

Despite statistics showing married couples and those with good health tend to make less severe claims, the Federal plan favored single, less healthy clients regarding pricing. For healthy or married couples, private plans could cost significantly less.

Compare Side-by-Side Long-Term Care Plans in 3 Minutes

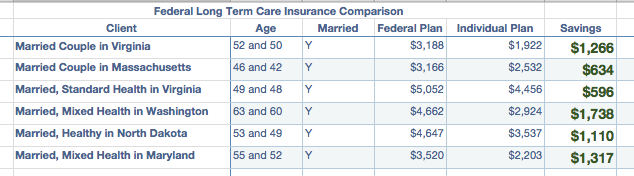

Sample Historical Federal Long Term Care Insurance Comparisons

Below is how private market plans once stacked up against the Federal Long Term Care (FLTCIP) Insurance plan. The individual plans shown were from Genworth (A), MassMutual (A++), and Mutual of Omaha (A+) versus actual quotes from the Federal plan on an annualized basis.

Note: The savings shown above are annual. Over the lifetime of the policy comparison, this could amount to tens of thousands of dollars in savings for many clients.

Find Out How Your Rates Compare: Federal vs Private Long Term Care Insurance

Request a quote from us and mention you are (or were) a Federal Employee. We’ll provide an apples-to-apples comparison and help you compare your options. Sometimes, the Fed plan might have been your best option, and we will disclose that.

Disclaimer

We are not affiliated with the U.S. Office of Personnel Management (OPM) or any federal agency. This information is for comparison purposes only. Please verify details with official plan documents.

Compare 10+ Top-Rated Insurance Plans

Save up to 40% on Long-Term Care Insurance

Our licensed experts will match your needs with the perfect plan.

100% free service • No obligation • No spam

Quotes Provided

Customer Rating

Trusted Service