Top Hybrid Long-Term Care Insurance Policies with Life Benefits in 2025

Updated June 7, 2025.

Written by Drew Nichols and Darrick Wilkins

In 2025, higher interest rates have significantly enhanced hybrid long-term care insurance policies with life benefits, making them more attractive than ever.

A new "Couples' Policy" has been introduced that covers both spouses with LIFETIME/Unlimited LTC benefits and pays cash benefit options, providing freedom to choose LTC caregivers, even from family members.

Higher interest rates have also made the return of premium (ROP) feature more attractive than ever, but we still suggest most people focus on the LTC benefits.

What is Hybrid Long-Term Care Insurance & Why Consider It?

A hybrid long-term care insurance policy combines traditional life insurance with long-term care benefits, providing financial protection for both scenarios. The core value proposition is leverage—a small allocation from your portfolio can create substantial protection.

Why these plans make financial sense: A healthy 60-year-old female can safely see a tax-free 89% return to her beneficiary through life insurance benefit (and 102% for a male of the same age) while also getting a 500% tax-free leverage on their money for Long-Term Care services.

Said another way, setting aside $100k of your retirement into a hybrid long term care plan can create a guaranteed return of between $189k – $202k tax-free to your loved ones through life insurance... but there's more to it than that.

At the same time the $100k premium can create a long-term care account of up to $607,000 for Long-Term Care services, paid in cash, tax-free. There is simply no other safe way to get this kind of leverage.

Takeaway: Re-allocate a small portion of your portfolio to protect a large portion of it. The leverage of 5-6x for LTC benefits and guaranteed life insurance payouts make hybrid policies compelling.

Who is Hybrid Long-Term Care Insurance For?

These plans are ideal for those with a net worth between $500,000 and $5 million. Below $500k, traditional LTC plans are more suitable, and above several million dollars, self-funding your future care costs can be less risky.

Compare Side-by-Side Long-Term Care Plans in 3 Minutes

The latest statistics from LongTermCare.gov indicate that 70% of those who live to age 65 will need long-term care, making protection essential for most retirees.

Can You Qualify? Health Requirements for Hybrid Policies

To get a hybrid long-term care insurance policy, you must be healthy enough to qualify based on the insurer's underwriting process. This approval process can be tough, especially after the COVID-19 pandemic made insurers more strict.

Conditions That May Disqualify You:

- Major health conditions: Cancer, heart disease, stroke, diabetes, or arthritis

- Mobility issues: Use of a cane or walker, recent falls

- Cognitive concerns: Memory issues or early signs of dementia

- Daily living assistance: Need help with bathing, dressing, or other activities

- Multiple medications: Taking several prescriptions may raise red flags

- Other factors: Being significantly overweight or having chronic conditions

Conditions Typically Acceptable:

- High blood pressure (controlled with medication)

- High cholesterol (controlled with medication)

- Minor health issues that are well-managed

The key is that insurers want to provide these policies only to those least likely to need care soon. They will review your entire health background and medical records.

A quick 5-minute phone call with an agent can give you an initial assessment of whether your health profile would meet the approval guidelines. If you don't qualify for hybrid policies due to health reasons, alternatives like annuities can still offer bonuses or benefits to help with long-term care costs.

Takeaway: You must be healthy to buy hybrid policies, but annuities can still be an option if you don't qualify. Don't assume you won't qualify without exploring your options first.

Key Features of Hybrid LTC Policies

Payment Options & Guaranteed Premiums

Unlike traditional LTC policies that have seen significant rate increases over the years, hybrid LTC policies offer guaranteed premiums that will never increase. This predictability is crucial for retirement planning.

Payment options include: 1. Single-pay (one lump sum) - Most popular for those with accumulated assets 2. 5-year pay - Spreads the cost while still limiting payment period 3. 10-year pay - Lower annual payments than 5-year 4. Annual pay for life - Smallest annual payment but continues throughout life

Single-pay or limited-pay (5 or 10 years) can be a "set it and forget it" approach, freeing you from the worry of rate hikes in later retirement years.

Takeaway: Hybrid LTC plans have guaranteed premiums that won't increase, unlike traditional policies. Choose a payment schedule that fits your financial situation.

Cash Indemnity Benefits: Maximum Flexibility

Many of the best hybrid long-term care insurance plans pay benefits as cash indemnity, meaning you receive tax-free monthly payments without submitting receipts or getting care providers approved.

Benefits of cash indemnity:

- Use funds for any type of care (nursing home, assisted living, home care)

- Pay family members to provide care

- No paperwork or receipts required

- Some companies don't even have claim forms—they just mail checks monthly

- Complete flexibility in how you spend the benefits

Cash benefits are becoming the industry standard as consumers recognize the advantages over reimbursement policies. Companies like Nationwide and Securian's Minnesota Life lead in offering these consumer-friendly benefits.

Takeaway: Choose cash indemnity benefits over reimbursement policies when possible. In 2025, cash policies are often less expensive than reimbursement policies.

Balancing LTC, Death Benefit, and Cash Value

Most hybrid policies let you focus on: 1. Maximizing LTC benefits - Best for those primarily concerned about care costs 2. Maximizing death benefit - For those wanting to leave more to heirs 3. Preserving cash/surrender value - If you might need to cancel and access funds

It's difficult to maximize all three simultaneously because each feature carries additional risk and cost to the insurer. If your main goal is coverage for LTC expenses, consider emphasizing the LTC benefit over the other features.

Special Features: Unlimited Benefits & Inflation Protection

Unlimited (Lifetime) LTC Benefits: While traditional LTC insurers largely discontinued lifetime benefit options in 2012, certain hybrid LTC plans in many states still provide unlimited monthly coverage for life. For those worried about long-term or catastrophic needs (like Alzheimer's over 10+ years), this can be crucial—even if the premium is higher.

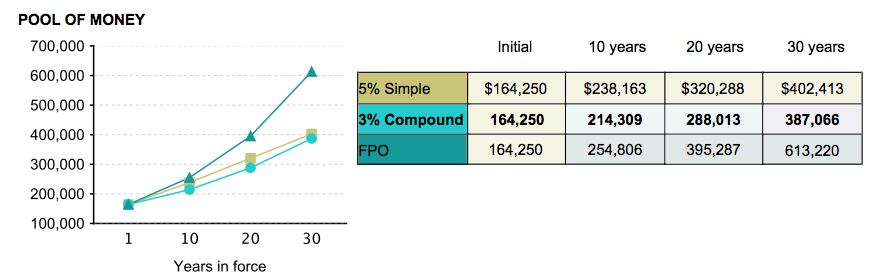

Inflation Protection: Some hybrid LTC plans offer optional inflation riders (e.g., 3% or 5% compound), which can be crucial if you expect to use benefits 20+ years in the future. Traditional LTC policies may have more robust inflation options, but hybrid plans sometimes omit or limit them. Ask your specialist how inflation protection affects your total LTC pool and premium.

Real-World Example: Understanding the Numbers

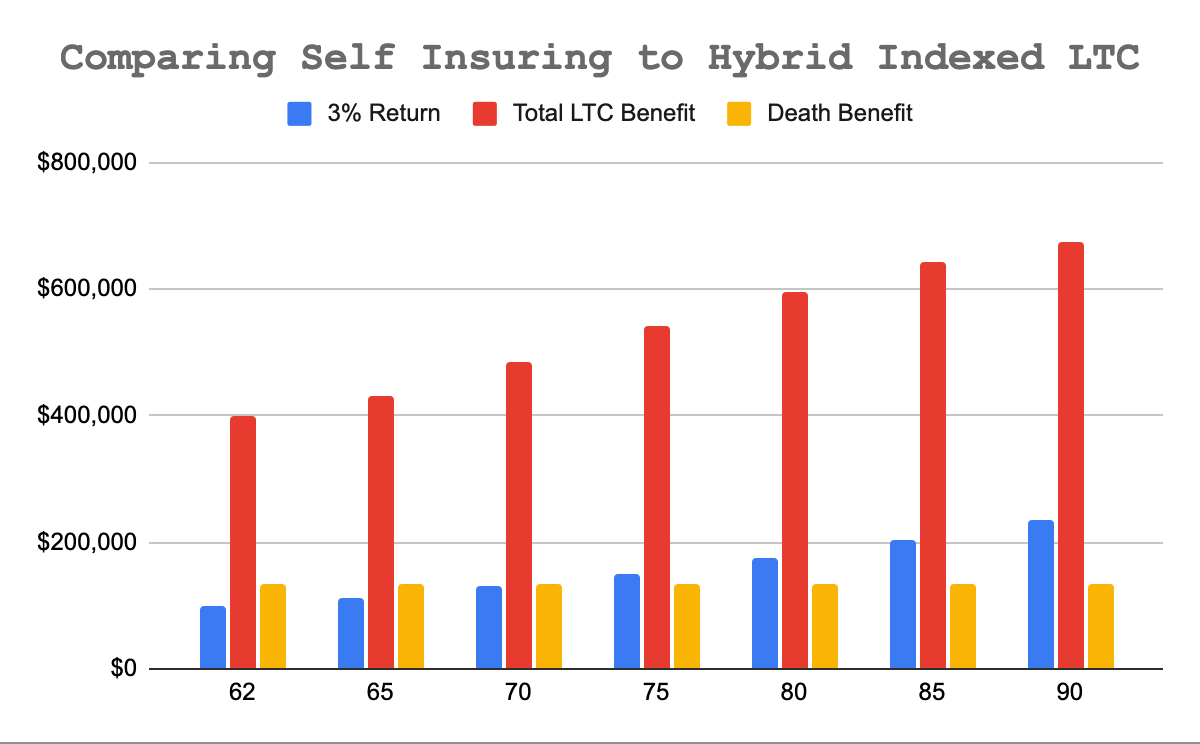

Let's examine a healthy 62-year-old male purchasing a hybrid policy with a single premium of $100,000:

- LTC Benefits: $398,638 (nearly 4x leverage)

- Life Insurance Benefit: $135,591 (guaranteed to beneficiary if LTC not used)

- Growth potential: With S&P indexed options, benefits can grow but never decrease

Here's how this compares to self-insuring with a 3% bond fund return:

The trend is clear: Long-term care benefits significantly outpace self-insured returns, and all benefits are tax-free (unlike investment returns).

Takeaway: A $100k premium can create nearly $400k in LTC benefits—leverage you can't achieve through traditional investments.

Real-World Case Examples

Case 1: The Early Planner (Age 52)

Profile: Married female executive, $1.2M net worth, excellent health

- Premium: $75,000 single-pay

- LTC Benefits: $600,000 (8x leverage)

- Death Benefit: $150,000

- Result: Maximum leverage due to young age and good health

Case 2: The Recent Retiree Couple (Both Age 65)

Profile: Married couple, $800k net worth, minor health issues (controlled hypertension)

- Premium: $200,000 joint single-pay

- LTC Benefits: $800,000 shared pool

- Death Benefit: $200,000 to survivor

- Result: Shared coverage protects both while preserving estate

Case 3: The Estate Planner (Age 70)

Profile: Widowed male, $3M net worth, focused on leaving legacy

- Premium: $150,000 single-pay

- LTC Benefits: $450,000 (3x leverage)

- Death Benefit: $225,000

- Result: Lower leverage due to age, but strong estate preservation

Case 4: The IRA Converter (Age 58)

Profile: Single female, $600k in IRA, wants to reduce taxable estate

- Strategy: Used $125,000 IRA rollover via SPIA

- LTC Benefits: $625,000 (5x leverage)

- Death Benefit: $125,000

- Result: Converted taxable IRA to tax-free benefits

Takeaway: Your age, health, and financial situation determine your leverage and optimal strategy. Earlier purchases yield dramatically better results.

Cost of Hybrid Long-Term Care Insurance

Hybrid LTC insurance costs vary based on:

- Your age (younger buyers get better leverage)

- Gender (women pay more due to longer life expectancy and higher care usage)

- Health status

- State of residence

- Desired benefit amounts

- Payment schedule chosen

Typical premium ranges:

- Single-pay: $75,000 - $200,000 per person

- 10-year pay: $7,500 - $20,000 annually

- Pay-to-100: $3,000 - $10,000 annually

For couples, joint policies may offer savings but compare both joint and individual options as pricing can vary.

Top Hybrid Long-Term Care Insurance Companies

When investing a substantial premium, choose only A+ rated or better companies. Here are the market leaders:

For Couples: Joint Plans

- Unique feature: Accepts IRA/401k rollovers

- Offers true lifetime/unlimited benefits

- Strong cash indemnity options

- Joint policy covers both spouses with shared pool

Nationwide Care Matters Together

- Competitive pricing for couples

- Flexible benefit options

- Cash indemnity available

- Simplified underwriting process

For Singles and Couples: Individual Plans

- No phone interview required for underwriting

- Strong inflation protection options

- Competitive for single buyers

- Return of premium rider available

- Market leader with extensive options

- Strong cash value accumulation

- Multiple payment schedules

- Excellent for estate planning focus

- Best-in-class cash indemnity benefits

- No elimination period options

- Strong for younger buyers

- Simplified claims process

- Flexible premium payment options

- Strong inflation protection

- Cash indemnity leader

- Extension of benefits rider available

Individual plans provide a firewall between spouses' benefits and often have pricing advantages, so compare both options.

Takeaway: Each company has unique strengths. Work with an independent agent who can match your specific needs to the right carrier's specialties.

Living Your Best Retirement: Peace of Mind in Action

With a hybrid long-term care policy in place, you can focus on what matters most—enjoying your retirement years without the constant worry about potential care costs. Whether it's traveling the world, spending time with grandchildren, or simply enjoying your favorite hobbies, knowing you're protected allows you to live life to the fullest.

Many of our clients tell us that purchasing hybrid LTC insurance was one of the best decisions they made for their retirement. The peace of mind it provides—knowing they won't burden their children or deplete their life savings—allows them to truly relax and enjoy their golden years on the golf course, at the beach, or wherever their retirement dreams take them.

Advanced Strategy: Using Your IRA to Fund a Hybrid Policy

It's possible to pay for a hybrid policy from your retirement account (IRA) via a SPIA (Single Premium Immediate Annuity). Since life insurance policies cannot accept direct IRA transfers, you first transfer the IRA money to the annuity, which then pays the premium.

Key points:

- Taxes are deferred and spread over 10 years

- Only select companies accept this structure (e.g., OneAmerica AssetCare)

- Consult with a CPA before making any IRA transfers

- Must specify upfront if using IRA funds

The IRS provides guidance here and here.

When Should You Buy Hybrid LTC Insurance?

The ideal time to purchase hybrid LTC insurance balances affordability, insurability, and maximizing benefits:

Age 50-55:

- Best leverage (6-8x for LTC benefits)

- Lowest premiums relative to benefits

- Easiest health qualification

- 30+ years for benefits to grow

Age 56-65:

- Still strong leverage (4-6x for LTC benefits)

- Most popular buying age

- Health issues may start appearing

- Good balance of affordability and need

Age 66-75:

- Lower leverage (2-4x for LTC benefits)

- Higher premiums

- Health qualification becomes challenging

- Consider if you've delayed too long

Key insight: Every year you wait costs approximately 3-5% more in premiums and reduces your leverage. A 55-year-old might pay $75,000 for $500,000 in benefits, while a 65-year-old pays $100,000 for $400,000 in benefits.

Takeaway: The sweet spot for purchasing is ages 50-65 when you're healthy and can maximize leverage. Don't wait for a health scare—by then it's too late.

How to Choose: Traditional vs. Hybrid Comparison

Quick Comparison Table

| Feature | Traditional LTC | Hybrid LTC |

|---|---|---|

| Premium Guarantee | No - subject to increases | Yes - locked in forever |

| Death Benefit | None - use it or lose it | Yes - returns premium minimum |

| Initial Cost | Lower - $3-5k/year | Higher - $75-200k total |

| Payment Period | Lifetime payments | 1, 5, 10 years or single pay |

| Cash Value | None | Yes - can surrender if needed |

| Benefit Payout | Usually reimbursement | Often cash indemnity |

| Inflation Protection | Robust options | Limited options |

| Best For | Lower net worth (<$500k) | Mid to high net worth ($500k-$5M) |

See how compound growth affects your benefits over time:

How the Claims Process Works

Understanding the claims process before you buy helps ensure you choose the right policy. Here's what to expect:

Qualifying for Benefits

To trigger benefits, you must meet one of these conditions: 1. Unable to perform 2 of 6 Activities of Daily Living (ADLs): Bathing, dressing, eating, toileting, transferring, continence 2. Cognitive impairment: Alzheimer's, dementia, or similar conditions requiring supervision

The Claims Process

Step 1: Initial Notification

- Contact the insurance company (or have a family member do so)

- Provide policy number and basic information

- Company sends claim forms and assigns a care coordinator

Step 2: Medical Certification

- Your doctor completes forms certifying your condition

- May require assessment by company's healthcare professional

- Typically takes 2-4 weeks for approval

Step 3: Elimination Period

- Most policies have 0-90 day waiting period

- You pay for care during this time

- Clock starts when you're certified as eligible

Step 4: Benefit Payments Begin

- Cash indemnity: Monthly checks sent directly to you, no receipts needed

- Reimbursement: Submit receipts for covered services

- Benefits continue as long as you qualify

Making Claims Easier

- Choose cash indemnity to avoid paperwork

- Select 0-day elimination period if available

- Keep policy documents accessible to family

- Consider appointing a family member as authorized representative

Takeaway: The simpler the claims process, the better. Cash indemnity benefits with no elimination period provide the smoothest experience during stressful times.

Frequently Asked Questions (FAQs)

Q: What is a hybrid long-term care insurance policy?

A: A hybrid long-term care insurance policy combines traditional life insurance with long-term care benefits, providing financial protection for both scenarios.

Q: Are the premiums for hybrid LTC policies guaranteed?

A: Yes, hybrid LTC policies offer guaranteed premiums, ensuring your costs won't increase over time. Always confirm this with your provider before purchasing.

Q: Can I use my IRA to pay for a hybrid LTC policy?

A: Yes, through specific arrangements like a Single Premium Immediate Annuity (SPIA). Only certain companies offer this option.

Q: What are cash indemnity benefits?

A: Cash indemnity benefits pay out a set amount of money directly to you, giving you flexibility to use the funds as needed without submitting receipts.

Q: Which policy features should I focus on—LTC benefits, death benefit, or cash value?

A: Most buyers prioritize LTC benefits. It's difficult to fully maximize all three features simultaneously.

Q: Are unlimited (lifetime) LTC benefits still available?

A: Yes, some hybrid carriers still offer truly lifetime benefits, although they're expensive. This can be vital for those concerned about catastrophic care needs.

Q: Do I get anything back if I never need care?

A: Yes, your beneficiaries receive a life insurance death benefit, typically at least equal to premiums paid.

Q: What are state partnership programs?

A: Partnership programs allow you to protect assets from Medicaid spend-down requirements. If you exhaust your LTC benefits, you can keep assets equal to the benefits paid and still qualify for Medicaid. Not all states offer this, and hybrid policies may have limited partnership qualification.

Q: How do elimination periods work?

A: The elimination period is like a deductible in time—you pay for care yourself for 0-90 days before benefits begin. Choose shorter periods (or zero) for easier claims, though premiums will be higher.

Ready to Protect Your Future?

Hybrid long-term care insurance policies offer powerful leverage, guaranteed premiums, and the flexibility of life insurance. With 70% of people over 65 needing long-term care, these policies provide essential protection for your retirement assets.

Get Your Free Comparison Today: Start Your 2-Minute Quote

Our independent service compares all major carriers side-by-side, ensuring you get the best coverage for your situation. Don't wait—the younger and healthier you are, the better your options and pricing.

Disclosure: We work with every major hybrid LTC insurance company and have no preference to any one carrier. Our goal is finding the right policy for your specific needs and situation.

Compare 10+ Top-Rated Insurance Plans

Save up to 40% on Long-Term Care Insurance

Our licensed experts will match your needs with the perfect plan.

100% free service • No obligation • No spam

Quotes Provided

Customer Rating

Trusted Service