Massachusetts Mutual

Headquartered in Springfield, Massachusetts, the Massachusetts Mutual Life Insurance Company (MassMutual), founded in 1851, is an American mutual life insurance company serving five million clients.

Adding long-term care insurance to their product catalog in 2000, MassMutual also offers life insurance, retirement management accounts, college savings plans, disability income insurance, investment services, trust services, mutual funds, exchange traded funds, 529 college savings plans, wealth management, financial planning and private client services.

Mass Mutual Long-Term Care Insurance Solutions

The MassMutual SignatureCare 500 and SignatureCare 600 policy series are traditional long-term care insurance plans that are tax-qualified and partnership plan eligible in most states. A comprehensive plan base is designed to protect retirement assets and income by helping to pay for home health care, assisted living facility care, adult day care, facility care and more.

Compare Side-by-Side Long-Term Care Plans in 3 Minutes

MassMutual SignatureCare 500 Series

MassMutual Signature Care 500 Series is available in the following nine states...

- Arizona

- California

- District of Columbia (DC)

- Florida

- Hawaii

- Montana

- New Jersey

- New York

- South Dakota.

*at date of writing, January 2020

Pricing on the SignatureCare 500 policy series is non-gender discriminate, a factor that may be significant for those states' residents, particularly female, seeking to purchase traditional long-term care insurance at one of the most affordable premium rates.

With options for $50-$400 daily benefit amount, the Base Policy is a "Facility Services Only" policy which covers facility services including a prescription drug benefit, bed reservation and the option of a Personal Care Advisor with no additional charge. Coverage is available outside of the United States, subject to the same eligibility requirements and separate contract elimination period, with no term or duration limitations.

The Comprehensive Policy offered by MassMutual includes the Facility Services with the addition of the Home and Community Based services, up to the daily benefit amount chosen. Included are the benefits in the base policy as well as benefits for Home and Community Based Services, Caregiver Training, Ambulance Services, Emergency Response System services, Respite Care and Alternate Plan of Care Services.

MassMutual SignatureCare 500 offers a choice of 30, 60, 90, or 180-day Elimination Periods, and this period is satisfied only one time in the life of the policy, if provided in the United States. The Optional Care Advisor and Respite benefits are exempt from elimination period.

The optional riders on this plan provide for waivers of elimination periods for home based services, monthly payment rather than daily for Home Care Based Services, Shared Care (an identical third benefit pool for use by either or both), waiver of premiums for both partners when one is receiving qualified long-term care services, paid up survivor benefit, an enhanced elimination period allowing covered individuals to advance more quickly through elimination periods (Comprehensive policy only) and a rider that will assure a portion of your policy remains available in the event of lapse of payment.

Discounts – MassMutual SignatureCare 500:

Couple - both applying: 30% discount if you and your spouse or partner each buy the same long-term care policy.

Couple - one applying: 15% discount.

Loyal Customer Discount: 5% if you have a *qualified and active MassMutual policy.

*Subject to eligibility and varies by state

Coverage is available for ages 40 - 75.

MassMutual SignatureCare 600 Series

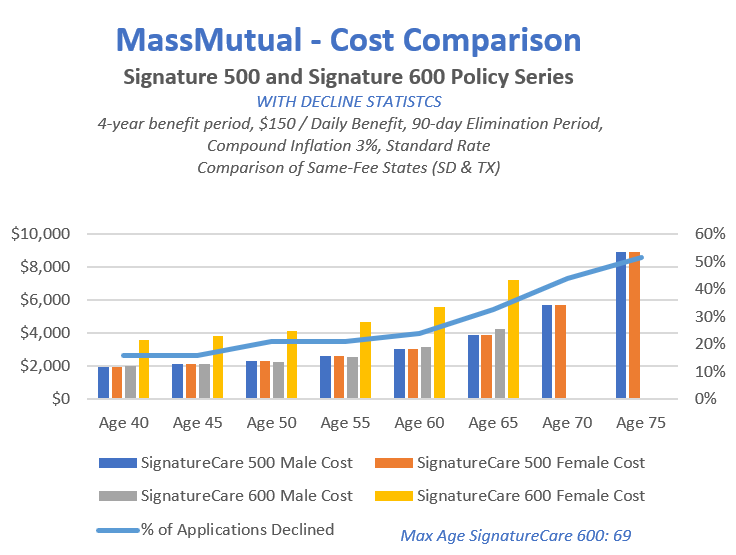

Launched in February 2019 in 39 states, the MassMutual SignatureCare 600 policy series replaced the non-gender discriminate MassMutual Signature Care 500 policy in those states, with the most critical observation being steep premium increase to female-gender applicants. This was a product change that aligned MassMutual's long-term care calculations with most competitor methodologies, as females were priced significantly higher in competing plans.

The following is a summary of the most significant policy changes in this series:

- A new "live at home" feature provides an additional benefit amount to cover certain services delivered in the home. This new benefit amount equals a maximum of sixty (60) days and is separate from a policyowner's total benefit amount.

- An enhanced elimination period which counts home and community-based services received on one day of a calendar week as seven days toward the elimination-period total.

- Reduction in discount for married/partnership applying for coverage together.

- The shared benefit rider is not an option in this series.

- Coverage age maximum reduced from age 75 to age 69.

Coverage is available for ages 40 - 69.

Discounts -MassMutal SignatureCare 600:

Couple - both applying: 15% discount if you and your spouse or partner each buy the same long-term care policy.

Couple - one applying: 15% discount.

- AM Best: A++ Superior

- Fitch: AA+Very Strong

- Standard & Poors: AA+Very Strong

- Moody's: Aa3 High Quality

Customer service ratings not available with specificity to Long-Term Care with the exception of those characterized as promotional.

Compare 10+ Top-Rated Insurance Plans

Save up to 40% on Long-Term Care Insurance

Our licensed experts will match your needs with the perfect plan.

100% free service • No obligation • No spam

Quotes Provided

Customer Rating

Trusted Service