Long-Term Care Insurance by Mutual of Omaha

We outline the pros and cons of Mutual of Omaha versus the competition.

Updated 03/30/2022

Who is Mutual of Omaha?

Many who grew up in the 60s and 70s remember Marlin Perkins and the beloved Mutual of Omaha's Wild Kingdom. The company has a rich history that goes way beyond that.

Founded in 1909, Mutual of Omaha is a Fortune 500 company providing insurance, banking, and financial products for individuals, businesses and groups throughout the United States.

What does Mutual of Omaha Sell Besides Long Term Care Coverage?

In addition to long-term care insurance, which emerged into product offerings in 1987, the company provides a variety of financial services, including:

- Medicare Supplements

- Life Insurance

- Annuities

- Group coverage including life, disability and 401(k).

Why is Mutual of Omaha So Popular?

Mutual of Omaha is typically in the top two companies selling LTC policies, by market share. There are a few reasons people choose Mutual of Omaha (MOO):

- They are well distributed. Many agents who sell a few policies a year rely on Mutual of Omaha since they are friendly to small independent brokers.

- MOO's policy is actually robust. Beyond being a convenient option, they include rich benefits "out of the box" in many cases.

When Should You Buy Long-Term Care Coverage?

Timing your purchase of long-term care insurance will revolve around a few key factors, each of which plays an important role in cost and eligibility.

Age: You will want to purchase a policy as early as is feasible for your budget, but not before age 50. The majority of our clients who secure a policy are between 55 and 64. Our youngest clients are successful folks in their late 40s and our oldest clients are typically late 60s.

Health: This really should be number one, because regardless of age, your health is the most important factor in your ability to qualify for a policy. According to the Administration for Community Living, someone turning 65 today has a nearly 70% chance of needing long-term care services in their lifetime.

Compare Side-by-Side Long-Term Care Plans in 3 Minutes

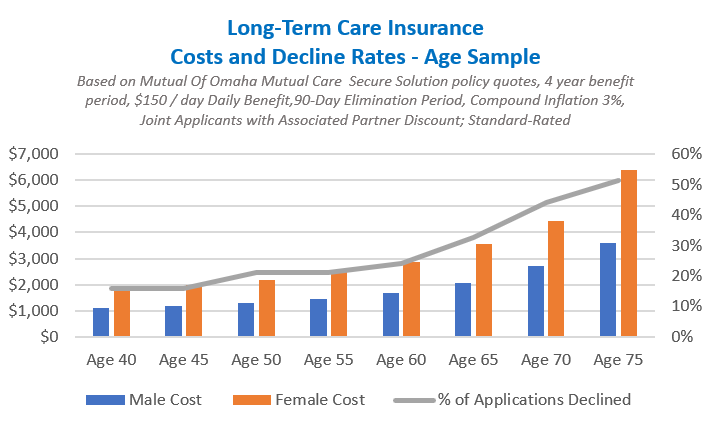

Here's a graph of premium costs, approval rates, and ages of typical purchaseers. You can see that costs rise, while the percentage of cases Declined (as in, not approved!) rises steadily with age. This chart really shows why ages 50-60 are so critical for many applicants.

What's the Difference Between MutualCare Secure and Custom Solution?

What's the same:

- Mutual of Omaha's MutualCare Secure Solution and MutualCare Custom Solution are tax-qualified and partnership-qualified traditional long-term care plans.

- Designed to protect your retirement assets and income. While Medicare generally does not cover long-term care, these policies help fill that gap.

- Pay for home health care, assisted living facility care, adult day care, facility care and more.

Where things differ:

MutualCare Secure Solution Long-Term Care Insurance:

MutualCare Secure Solution is a traditional long-term care policy providing payment for qualified long-term care services and security for retirement savings. With options for $1,500 to $10,000 in monthly benefits for nursing home assisted living, adult day care and in-home care expenses, this plan includes many other rich benefits, _built in,_ in example, a cash benefit; 30% of your monthly benefit available from day one of a qualified and physician-certified care event, with no receipts to submit, and waiver of premium while you are receiving the cash benefit or covered home health care services at least eight days in a month or assisted living or nursing home services.

New to this plan is the "compounding 20 years" feature, at 3% or 5%; an excellent tool for premium reduction for those in their 60s and 70s seeking to build a more affordable long-term care policy with focus on long-term care costs at the average age of need for long-term care services.

MutualCare Custom Solution Long-Term Care Coverage:

MutualCare Custom Solution provides greater customization in many areas, allowing for a plan built for your specific vision for long-term care. MutualCare Custom Solution has all the benefits of MutualCare Secure Solution, plus:

- Greater elimination (waiting) period options

- Numerous options for inflation protection

- Joint waiver of benefits option

- Increased cash benefit (40%)

- Return-of premium options

-

Plan durations greater than five (5) years.

With options for $1,500 to $10,000 in monthly benefits for nursing home, assisted living, adult day care and in-home care expenses, this plan allows for specific budgeting in offering partial years (e.g. 2.3 years coverage) with plan build years up to 8.3 possible.

Inflation Protection Options

Worthy of mention, inflation compounding duration options in this plan are available in 10, 15 and 20 years; which allows for increased focus on premium pricing for those in their 60s and 70s. The joint waiver of premium optional rider assures that when one insured is in a qualified care event, no premiums are due during that time for either insured.

MutualCare Custom Solution is ideal for individuals and couples who want to be very specific with long-term care planning.

For both plans, there is comfort in the Alternate Care _benefit, built into the plan for "services or treatments that don't exist today yet may become standard practice in the future as well as the _International Benefit, which pays up to 12 months of maximum monthly benefit for qualified care received when traveling outside of the US, Canada or UK.

Discounts:

- Couple - both applying: 30% discount if you and your spouse or life partner each buy the same long-term care policy from Mutual of Omaha.

- Couple - one applying: 15% discount.

- Preferred discount: 15% if you are in good health, after application and at underwriting, you may qualify for a preferred rate.

Mutual of Omaha Financial Ratings:

AM Best: A+ Standard & Poors: AA- Moody's: A1

Compare 10+ Top-Rated Insurance Plans

Save up to 40% on Long-Term Care Insurance

Our licensed experts will match your needs with the perfect plan.

100% free service • No obligation • No spam

Quotes Provided

Customer Rating

Trusted Service