Apr 19th, 2025

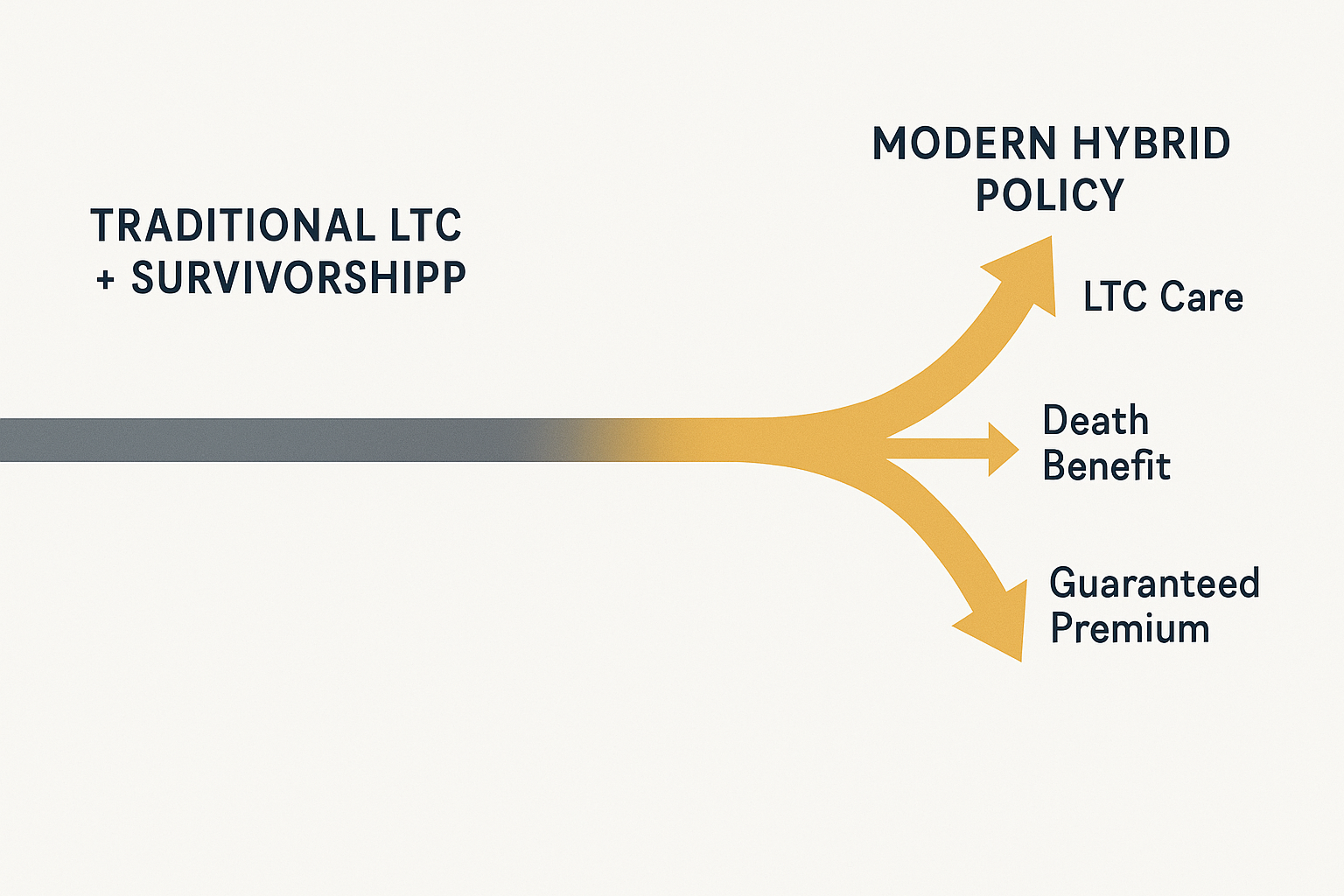

Should Survivorship be added to my Long Term Care policy? Is it worth it? With the rise of hybrid policies in 2025, this question requires careful consideration.

What is Survivorship?

Survivorship is a rider (optional feature that costs additional money) that couples can add to their traditional Long Term Care Insurance policies. With Survivorship, when one spouse dies, the surviving spouse no longer has to pay their Long Term Care Insurance premium.

Important Note for 2025

Before considering a survivorship rider, you should first evaluate whether a hybrid long-term care policy might better suit your needs. Hybrid policies have become increasingly popular due to their guaranteed premiums and built-in death benefits, often making survivorship riders unnecessary.

Important Market Context for 2025

The long-term care insurance landscape has transformed dramatically. While traditional policies with survivorship riders once dominated the market, hybrid policies now represent over 85% of new long-term care insurance sales. This shift is primarily due to:

- Guaranteed premiums in hybrid policies

- Built-in death benefits that return premiums if care isn't needed

- More flexible payment options (single-pay, 5-pay, 10-pay, or lifetime)

- Cash indemnity benefits that don't require receipts or approved providers

What Companies Still Offer Survivorship?

While survivorship riders were common in the past, the market has shifted significantly. As of 2025, fewer companies offer traditional long-term care policies with survivorship riders. The main carriers still offering this feature include:

- Mutual of Omaha

- New York Life

- Thrivent (for eligible Christian members)

- Several smaller carriers (availability varies by state)

Most policies require a ten-year qualification period, meaning both partners must maintain their policies for 10 years before the survivorship benefit becomes active.

Premium Considerations

When offered, survivorship riders typically add 15-20% to the base premium cost. For a couple aged 60, this might mean an additional $600-800 annually.

A Real-World Comparison: The Smiths vs. The Joneses

Let's compare two couples, both age 60, each looking for long-term care protection:

The Smiths (Traditional with Survivorship):

- Base premium: $4,000/year for both spouses

- Survivorship rider adds 15%: $600/year

- Total annual cost: $4,600/year

- Premium subject to future rate increases

- If Mr. Smith passes after 10 years, Mrs. Smith's premiums stop

- If neither needs care, all premiums paid ($46,000+) are lost

The Joneses (Joint Hybrid Policy):

- Premium: $5,000/year for 10 years (then paid up)

- Total investment: $50,000

- Premiums guaranteed—no future increases

- Creates $300,000+ shared LTC benefit pool

- If Mr. Jones passes, Mrs. Jones keeps full access to benefits

- If neither needs care, heirs receive $50,000+ tax-free death benefit

The Verdict: For similar costs, the Joneses get guaranteed premiums, retain value if care isn't needed, and avoid the complexity of survivorship qualification periods.

Is Survivorship Worth It in 2025?

With our concrete example above, you can see how the financial equation has shifted. Let's examine the specific scenarios where each option shines:

Why You Might Skip Survivorship

- Hybrid Policies: Hybrid long-term care policies offer guaranteed premiums and death benefits, often making survivorship unnecessary

- Cost Efficiency: The extra premium for survivorship could be better invested elsewhere

- Market Changes: With fewer carriers offering traditional policies, hybrid options often provide better overall value

When Survivorship Might Make Sense

- If one spouse has significant pension or Social Security income that will stop upon death

- When there's a large age gap between spouses

- If you specifically want traditional LTC insurance and plan to keep it long-term

Modern Alternatives to Survivorship

The market now offers superior options for couples:

1. Joint Hybrid Policies

- Companies like OneAmerica offer shared care with unlimited lifetime benefits

- Both spouses share one large pool of money

- Surviving spouse retains access to unused benefits

- Cash indemnity payments available

2. Individual Hybrid Policies

- Guaranteed premium rates

- Return of premium options

- Built-in death benefits

- Optional inflation protection

3. Linked-Benefit Solutions

- Combines life insurance with LTC benefits

- Typically offers more flexible payment options

- May provide better tax advantages

- Often includes return of premium features

Making the Right Choice in 2025

Your decision should align with your broader financial planning goals:

- For Estate Planning Focus: Hybrids win—they guarantee a return of value either through care benefits or death benefits

- For Maximum Care Coverage: Traditional policies may offer longer benefit periods, but hybrids provide more predictable costs

- For Simplicity: Hybrids eliminate the survivorship waiting period and premium payment complexity

- For Legacy Protection: Only hybrids ensure your premiums aren't lost if care isn't needed

Tax Considerations

Unlike traditional policies, hybrid policies often offer:

- Tax-free benefits for long-term care

- Tax-free death benefits to beneficiaries

- Potential 1035 exchange options from existing life insurance or annuities

- More favorable treatment of premium payments

The Bottom Line

Survivorship riders served a valuable purpose when traditional long-term care insurance dominated the market. Today, they remain a viable option for specific situations—particularly when one spouse has income that stops at death or when there's a significant age gap between partners.

However, the mathematics of modern insurance have shifted. With guaranteed premiums, death benefits, and more flexible payment options, hybrid policies often deliver the peace of mind that survivorship riders were designed to provide—without the added cost and complexity.

The key is understanding your unique situation and comparing all available options with an experienced specialist who can show you both traditional and hybrid solutions side by side.

Questions to Ask Your Agent

When discussing your options, consider asking: 1. What are the total costs over 20 years for each option? 2. How do the benefits compare between traditional with survivorship vs. hybrid policies? 3. What happens if we never need care? 4. Are there any rate guarantee periods? 5. How are benefits paid out when needed?

Compare 10+ Top-Rated Insurance Plans

Save up to 40% on Long-Term Care Insurance

Our licensed experts will match your needs with the perfect plan.

100% free service • No obligation • No spam

Quotes Provided

Customer Rating

Trusted Service