Feb 3rd, 2020

Tl;dr summary: Waiting to purchase Long-Term Care Insurance can be costly and you may become "un-insurable" due to unforeseen health changes.

In Life, Timing is Everything.

When people begin looking at Long Term Care Insurance policies, there is often a tendency to put off the actual purchase until later down the road. While rushing is a bad move, waiting too long to buy can cost you, too, sometimes much more.

Math on Cost of Waiting: Traditional and Hybrid Policies

Traditional LTC Policies are paid annually, for your entire life. By purchasing a policy at an earlier age, you secure a rate structure based on that younger age.

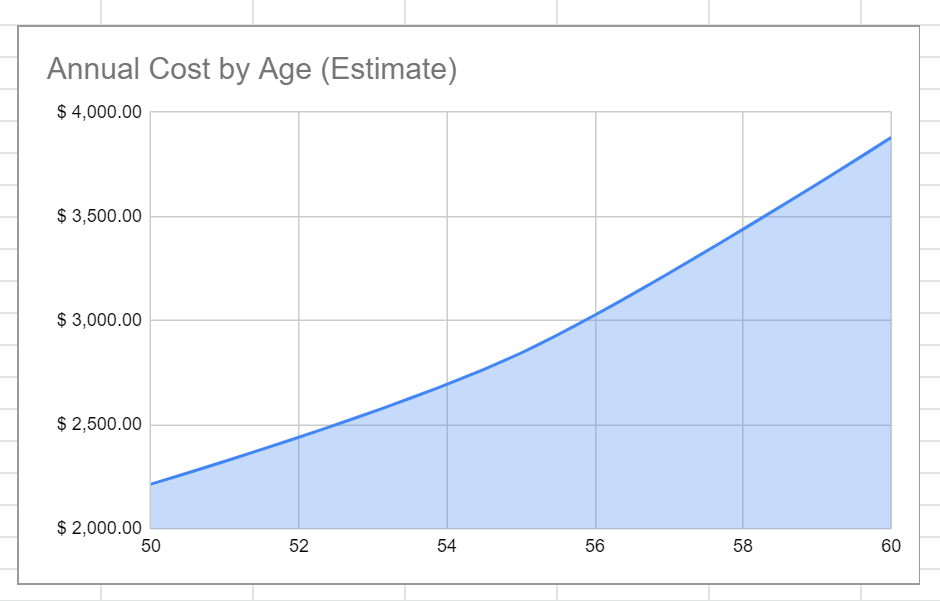

So, let's run some sample rates for a 50-year old couple in California (Rates will be similar elsewhere) and see what they pay today versus what they will pay in 5, and 10 years.

This 50-year-old healthy couple buys a 5-year, $200/day benefit with 3% compound inflation protection.

Buy Now: Each spouse will pay $2,214.18/year.

Wait 5 Years: Each spouse will pay $2,844.43/year.

Wait 10 Years: Each spouse will pay $3,879.16/year.

While the difference in premiums may not seem too bad, the total cost of owning a policy for a lifetime is nearly $20,000 more in expense.

What's even worse about waiting: because more of the budget is going to premiums instead of investments over the latter years of your life, you end up losing $61,000 in savings compounded in this experiment.

While rates can change with these types of policies in the future, you'll still be priced at that younger age which will lead to saving money. In our calculations, we assume no rate increases.

Hybrid Policies allow you to pay a single one-time premium. We've run similar numbers to illustrate the advantage you create by purchasing now versus waiting to buy using Nationwide Care Matters II as an example (state: Georgia, gender Female)

All of these configurations set up a benefit for Long-Term Care of over $1,130,000 (6 year benefit period) but look at how miuch premium you must pay to generate the exact same LTC benefit:

Buy Now: Premium $101,290

Wait 5 Years: Premium $137,241

Wait 10 Years: Premium $170,946

In that 10 years of "waiting" your $101,290 premium would generate a return of around $64k if invested at 5%, however capital gains taxes would be due, and you would not be covered against accidents or more importantly unexpected adverse health changes.

If you plan to buy a hybrid policy, buying at your current young age is advantageous to waiting. If hybrid policies seem confusing or you want to compare the blue chip plans side-by-side, request a quick quote on our site.

Carol's Story: The Looking Late

Real life story: Carol lives in St. Louis, Missouri, and after years of putting off buying a policy and thinking she didn’t need it, she eventually realized it was a wise purchase. Considering the risk of needing long term care increases once you reach the age of 65, she conceded to the fact that it makes sense to protect her assets from that risk.

At the ripe old age of 77, she sent us her information looking for a quote.

Carol began officially looking into plans in mid-April and we helped show her the various options. Despite the fact that few individuals would likely qualify for this kind of insurance at her age because of the high risk they pose to insurance companies, Carol was actually in excellent health. We sent her a binder with a quote comparison in the mail for her to look over. Exactly one week after LTC Tree mailed her a binder, Carol fell and broke her hip.

Tragic Timing

After finally realizing the importance of a Long Term Care Insurance policy, chances are it is now too late for Carol to ever qualify for a policy. Because she now has a broken hip on her record and she is 77 years old, the likelihood of a company insuring her is slim, even if she fully recovers from her hip injury. Now, rather than have the insurance company pay for the care needed to recover from breaking her hip, she is on her own when it comes to payment. If she ever needs care again in the future, once again, she will find herself paying out of pocket for that care. While this may be feasible for some people, the assets Carol has won’t last her long.

Because she only has $150,000 assets saved, her personal money will only take her so far. Her nest egg will cover the cost of two, possibly three years of care, depending on whether she receives it in a nursing home or at her own home. If she happens to need care for any longer than that during her lifetime, she will be out of assets and forced to either turn to a family caregiver or enroll in Medicaid due to her lack of assets.

Avoid Financial Devastation in 2016

Carol finally came to her senses at the age of 77, after recognizing the fact that long term care does pose a real risk to seniors’ retirement and it makes more sense to insure against the risk than it does to ignore it. Unfortunately, she waited just a little too long and the timing was devastating. This is a story that happens more than you might think, which is why we encourage consumers to look into Long Term Care Insurance in their 50s when they are still in good health and more likely to qualify health-wise for a policy.

If you are considering requesting a quote but haven’t done so yet, don’t hesitate. The quote we send you is completely free and there is no pressure to buy. Don’t just put the binder down and forget about it, though, because waiting too long may end up costing you big. Click here to learn more about Long Term Care Insurance or request a quote today.

Compare 10+ Top-Rated Insurance Plans

Save up to 40% on Long-Term Care Insurance

Our licensed experts will match your needs with the perfect plan.

100% free service • No obligation • No spam

Quotes Provided

Customer Rating

Trusted Service