Jan 14th, 2020

Virtually all companies who sold Long Term Care Insurance over a period of many years have had to go back and adjust rates on existing policyholders. Mutual of Omaha has increased rates on several policy forms it sold in the past. The reasons for rate increases vary, and this page is general in many ways and not specific to Mutual of Omaha. Recently, insurance companies have had to make adjustments to reflect a much lower expectation of interest income. While past economic environments produced reliable returns in the 4+% range, today's low rates seem to reflect a "new normal."

Terminology of Rate Increases Explained

When you investigate Long Term Care rate increases, you'll quickly encounter lots of archaic-sounding terms. This topic is full of forms, classes, and lots of code numbers.

Classes - The most nebulous term to watch out for when discussing Long Term Care Insurance Rate Increases is the concept of "classes." Often you'll find that companies use a disclaimer to the effect of we can't raise rates on you, but we can raise rates on everyone in a class in your state. The question is: how are these classes divided up?

**Policy Forms - **A form number is a state-approved policy that is sold during a certain period of time. Everyone in your state who purchases that same policy form may be considered part of a class, but again the class term is up for debate. A policy form will be available for sale during certain years. In recent years, we've seen policy forms last as little as a year before being replaced by a new form number. When it's time for a rate increase, the company will address the performance of each policy form series.

Some Examples of Rate Increases, by State:

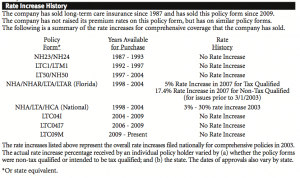

Your Long Term Care Insurance application has to disclose the rate increase history of the policy you're applying for as well as the company's other policies sold in the past. We've highlighted below that the current offering from Mutual of Omaha for sale has not raised premiums, but past policy form numbers have experienced increases.

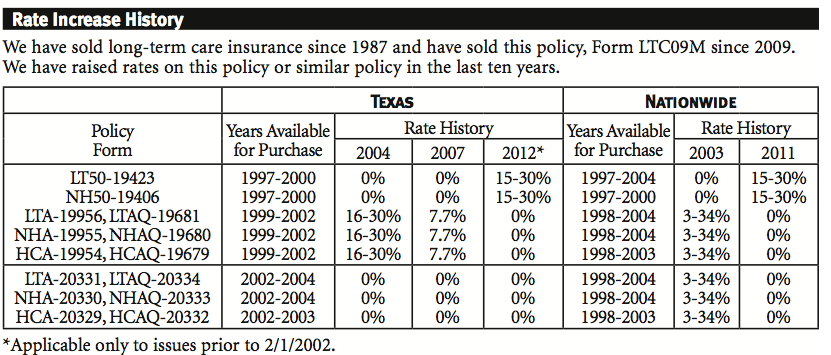

Each state has a slightly different disclosure. Some examples are below, all current as of October 2012:

Florida Mutual of Omaha Rate Increase Disclosure

Florida currently offers different policy forms than many states, and individually reviews company filings.

Florida also has a different rate increase history than many other states. You can see in the attached table that Florida policies experienced a 5% Rate Increase in 2007 for Tax Qualified policies, while policyholders in other states saw an increase of 3-30%. Each insurance department has different protocol for handling rate increases. Florida can require actuarial review of some rate increase requests.

» Review more on Florida Long Term Care Insurance options.

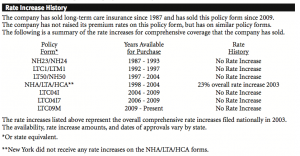

New York Mutual of Omaha Rate Increases

New York's form specifically states that on the NHA/LTA/HCA forms sold in the past and increased with a 23% overall increase in 2003, New York did not receive any rate increases on these forms.

New York, like Florida, has a unique regulatory environment. Often, you'll find that policies for sale in New York are a unique policy form number and not for sale in other states.

Texas Mutual of Omaha Rate Increase Disclosure

Compare 10+ Top-Rated Insurance Plans

Save up to 40% on Long-Term Care Insurance

Our licensed experts will match your needs with the perfect plan.

100% free service • No obligation • No spam

Quotes Provided

Customer Rating

Trusted Service