Compare California Long Term Care Insurance Quotes

California's LTC Comparison Quote Site

Have a question about Long Term Care in California? Call our customer assistance line at 818-452-4899.

Residents of California enjoy competitive Long Term Care Insurance rates from a variety of top-rated Life & Health insurance companies. California was one of the original states to approve a Partnership policy for state residents to potentially provide MediCal asset protection for all or a portion of your personal assets. To qualify, however, you must buy a very specific policy with specific benefits. (Learn More) If you live in California, you have access to different Long Term Care policies than are available in virtually any other state, so it's important to work with a California licensed (and Partnership-certified) agent who can represent as many insurers approved to sell LTC insurance in California as possible.

Long Term Care Insurance Discounts in California

There are several types of discounts approved in California, including a spousal/partner discount applied to married couples and domestic partners, as well as anyone who has shared common living expenses for a minimum period of time. California policies may also qualify for health discounts with several insurers, although one prominent insurance company only offers a Standard Rate to everyone. For the companies that do offer health discounts, premiums can vary by as much as 38% between rate classes. If you buy LTC from one of the major AAA rated Life insurance companies, they are approved to offer you an additional 5% Loyalty Credit, as well as the potential for an Employer 10% discount. Premiums can be as much as 30% lower for a married couple when both apply, or 15% lower just for checking the box that you're married if your spouse/partner is not applying.

A knowledgeable CA-licensed agent can assist you in finding all of the discounts you qualify for. Connect with one via our site if interested in comparing multiple company offerings.

How to Compare LTC Policies Sold in CA?

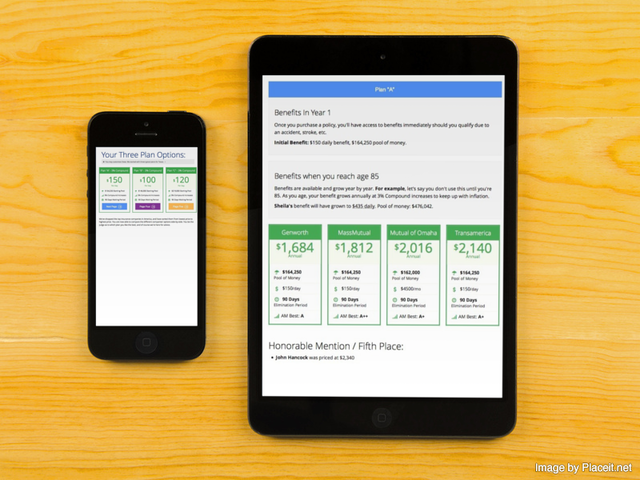

While there are different policies available in California than in many other states, LTC Tree developed custom software to compare as close to apples and apples between insurance companies as possible. We are able to take your age, health, and marital status and provide a comparison spreadsheet of the various company options for you across as many as four different benefit levels.

Our unique approach of providing colorful illustrations of current and future benefit payouts makes finding and understanding the core fundamentals of LTC insurance much easier. Review your quotes on your favorite iPad/Phone/Android.

Get Your Free Comparison of the Top 10+ Insurance Plans

Our educational process will match your needs and budget with the right insurance plan. We will help you compare A+ Long-term care plans, at no charge.