Sep 6th, 2012

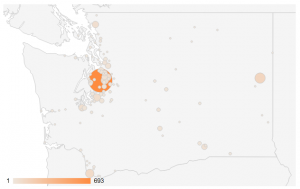

Live Data: **What cities in Washington are researching Long Term Care Insurance? Click to expand.

The Evergreen State accounts for 2.89% of the Long Term Care Insurance market, and 2.2% of the U.S. population, meaning Washingtonians protect themselves at higher proportions than the rest of the country. Washington residents are also known to be some of the healthiest in the United States, so Long Term Care insurers would be remiss to ignore this market.

Internal data suggest that Washington residents not only purchase Long Term Care Insurance in higher proportions, but also purchase larger policies.

Unique Features of Long Term Care in Washington

Washington has a unique and robust regulatory environment, meaning the Office of the Insurance Commissioner is serving its citizens well. The state has even set up a Long Term Care-specific site. The State site mentions that, "Washington state laws took effect Jan. 1, 2009, to further protect consumers who buy long-term care insurance." With the average time span between a purchase of a LTC policy and the actual claim being 20-30 years in most cases, having a well-regulated insurance market is of utmost importance to consumers.

There are 24 insurance companies approved in Washington, with nine companies approved for Partnership policies, which we recommend. The Partnership-approved companies are:

[divider]

Companies Selling Partnership Policies in Washington

- Bankers Life & Casualty Company

- Country Life Insurance Company

- Mutual of Omaha Insurance Company

- State Farm Mutual Automobile Insurance Company

- Thrivent Financial for Lutherans

- Transamerica Life Insurance Company

- United of Omaha Life Insurance Company

- United Security Assurance Company of Pennsylvania

[divider]

This data was collected and analyzed on September 6, 2012. Over time, we expect more companies to have Partnership-approved policies. Notable exceptions from this list are Genworth Life Insurance Company, the market share leader in Long Term Care Insurance. Additionally, we can quote Massachusetts Mutual Life Insurance Company, and New York Life Insurance Company, none of which are currently approved with Partnership forms.

[divider]

[button link="http://www.comparelongtermcare.org/quotehealth?state=Washington" color="#04B404" window="false" size="medium"]» Get Six Free Washington-specific Quotes »[/button] [divider]

Partnership Policies & State Requirements

[accordion sync="false"]

[accordion_item title="Under 61 years old" open="true"]

Under 61 years old: when you buy the policy, it’ll provide annual compounded inflation increases for benefits to cover the cost of your care. When you turn 61, you can change the inflation protection provision to meet the requirements of the next age bracket. [/accordion_item]

[accordion_item title="Ages 61 to 76"]

Ages 61 to 76: You must buy and keep some form of Simple inflation protection until you are 76. (Simple Inflation is a minimum - we recommend 5% compound for those expecting use out 15+ years) [/accordion_item]

[accordion_item title="After age 76"]

After age 76: Insurers must offer inflation protection, but you don’t have to buy it or keep it. [/accordion_item]

[/accordion]

Exchanging an older policy:

A common question of current Long Term Care Insurance policyholders in Washington is whether they are able to exchange their existing coverage for a newer policy to gain the advantages of the Partnership program. The state addresses this, saying:

You may exchange your existing policy, as long as your current policy was issued on or after Feb. 8, 2006, and it’s the type of policy certified for the Long-Term Care Partnership Program. However, some restrictions may apply. Check with your insurance company for details.

If your policy was issued before Feb. 8, 2006, check with your insurance company to see if they offer an option to exchange it for a Partnership policy.

[divider]

Washington Long Term Care Insurance News

Updates as needed with state regulations changes, product updates, etc.

January 2012:

Washington residents polled by King 5 report dissatisfaction with the mandate portion of the health care law. (Link) Read our take on the Health Care reform law here.

September 2012:

Washington updated their inflation protection rules surrounding CPI-Linked inflation models. (Read the amended regulation here.) Summary: Inflation protection of at least 3% Compound must be offered for Partnership compliance. CPI decreases cannot decrease benefits, but can be offset by future years. It is possible, though not certain, that Washington will approve previously sold policies as Partnership. Policies will have a Partnership Status Disclosure Notice included with them at issue if they have been approved.

Get Your Free Comparison of the Top 10+ Insurance Plans

Our educational process will match your needs and budget with the right insurance plan. We will help you compare A+ Long-term care plans, at no charge.