Jan 27th, 2023

Federal Long-Term Care Insurance Options

2023 Update: The Federal Plan is no longer available, AND there may be lower cost options on the private market. Especially if you are healthy... read on:

To get ballpark figures of how much Long Term Care Insurance Costs, check out our Online Calculator.

Federal Employees in the past had access to a Long Term Care program called the FLTCP 2.0. This plan provided a simple Long Term Care plan for Federal employees and their spouses. These plans offered comparable coverage to what is available from a host of private insurers. Sometimes the Federal Long Term Care plan’s prices were better, often they were worse.

- With the Fed LTC plan being sunset, you should compare your private market options.

Good Health Discount

If you’re healthy, you may qualify for a 10-20% discount with private plans. The Federal LTC Plan did not have a discount for good health. If you’re healthy, you’re being grouped in with all Federal employees and are probably paying more for coverage.

Marital / Partner Discount

If you’re married or have a partner, you qualify for discounts in the 30-40% range with private plans. The Federal LTC Plan did not have a discount for applying with a spouse! Missing out on a 40% discount is major.

Single, Standard Health (Not Great Health) Favored

Despite statistics that indicate married couples and those with good health tend to make less severe claims, the Federal plan favors single, less healthy clients when it comes to pricing.

The items listed above are factors in evaluating the Federal LTC plan versus private insurance plans. A first step should be to request a comparison Long Term Care Insurance quote from a trusted advisor or online broker. You want honest feedback on how the plans really compare, not bias and a sales pitch.

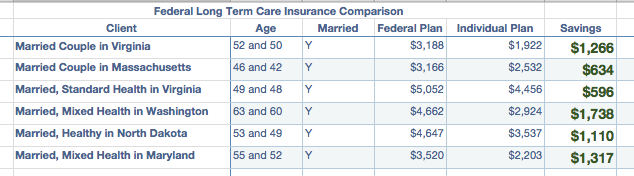

Sample Historical Federal Long Term Care Insurance Comparisons

Comparing private "market" insurance plans vs the Federal Long Term Care (FLTCIP) Insurance plan, here are some actual examples. The individual plans listed were from Genworth (A), MassMutual (A++), and Mutual of Omaha (A+) versus actual quotes from the Federal plan on an annualized basis. (You can only pay the Fed plan either monthly or semi-weekly.)

* Note: Savings are annual. Over the course of the policy, this could lead to tens of thousands of dollars for these real-world clients we analyzed.

Find Out How Your Rates Compare: Federal vs Private Long Term Care Insurance

Request a quote from us and mention you are a Federal Employee. We will provide an apples-to-apples comparison and help you compare your options. Sometimes, the Fed plan is your best option. We will disclose this.

Get Your Free Comparison of the Top 10+ Insurance Plans

Our educational process will match your needs and budget with the right insurance plan. We will help you compare A+ Long-term care plans, at no charge.