Mar 21st, 2013

We got a call from a client in Washington who was 59 and comparing Long Term Care Insurance options. She rattled through a list of benefits like payment duration, daily benefit amount, and then got to inflation protection. She dropped the 5% simple bomb without missing a beat and we continued on.

While 5% simple does qualify her for Partnership benefits, it is simply inadequate unless she plans to use this coverage in the next 5-15 years. With the average claim age being mis-80s now, it's unlikely that a sub-60-year-old will need care in 15 years. First, the Partnership rules:

Ages 61 to 76: You must buy and keep some form of Simple inflation protection until you are 76. (Simple Inflation is a minimum – we recommend 5% compound for those expecting use out 15+ years)

She's okay for Partnership purposes, but what about her actual benefits? Taking $200/day today and running the numbers, at average claim age the client will have more than $220/day in benefit with a 5% Compound option versus a 5% simple option.

Taking that math to its extreme, over the three year life of her policy she will benefit to the tune of $240,000 over the lifetime of the policy. With a premium difference of $400-$500/year more for 5% compound, and a $240k benefit, the risk-reward equation seems to favor 5% compound in this case.

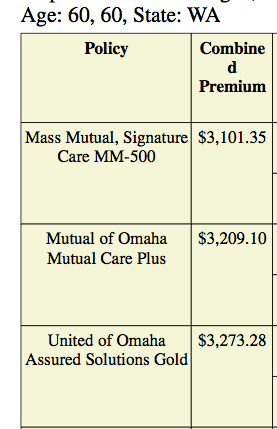

Get Your Free Comparison of the Top 10+ Insurance Plans

Our educational process will match your needs and budget with the right insurance plan. We will help you compare A+ Long-term care plans, at no charge.